Are you a contractor or employee?

Employees and contractors have different requirements when it comes to tax and superannuation obligations! The key point of difference is contractors work for themselves and employees work for an employer. If you hire a worker you must check if they are an employee or contractor. This is important because:

· it affects your tax, super and other obligations

· penalties and charges may apply if you get it wrong.

Note, the following workers are always treated as employees’: apprentices, trainees, labourers and trade assistants

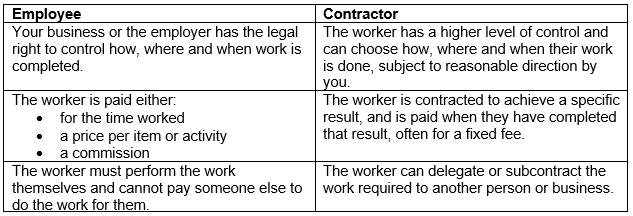

The ATO and Fair Work have prepared tables that outline the key identifiers between a contractor and an employee. It is important to note that no single identifier indicates if a worker is a contractor or employee, you must review the legal rights and obligations in the contract. The most common indicators include but are not limited to:

Your tax and super obligations

Depending on if your worker is a contractor or employee will significantly impact your tax and superannuation obligations.

If your worker is an employee you'll need to:

· withhold tax (PAYG withholding) from their wages and report and pay the withheld amounts to us

· pay super, at least quarterly by the required due dates, for eligible employees

· report and pay fringe benefits tax (FBT) if you provide your employee with fringe benefits.

If your worker is a contractor:

· they generally look after their own tax obligations, so you don't have to withhold from payments to them unless they don't quote their ABN to you, or you

have a voluntary agreement with them to withhold tax from their payments

· you may still have to pay super for individual contractors if the contract is principally for their labour

· you don't have FBT obligations.

It's against the law to incorrectly treat an employee as a contractor, therefore it is important that you are checking you've got it right. If you don’t get it right, penalties may apply.

You should also consider whether WorkCover and payroll tax applies.

For more information on how to determine if you are an employee or a contractor visit the ATO.